The Start of Something Great

The entire Blue Finance Group met one another in Segovia, Spain to celebrate the company’s 10-year-milestone it reached last year. All four operating regions and almost 40 employees from six different countries were present at the same time – for the very first time, together!

Segovia is a beautiful city on the autonomous community of Castile-Léon and is filled with history. The city is located at the crossing of two rivers, the Eresma and Clamoros, at the foot of the mountain range Sierra de Guadarraman, about an hour drive from Madrid. The city is famous for its historical buildings, some of which include the Roman aqueduct and Alcácar de Segovia, a castle that used as the model for the world famous Walt Disney castle. The city centre was declared a World Heritage Site by UNESCO in 1985. For us, Segovia was the perfect location and environment to meet our colleagues.

The Value of Face to Face Contact is Truly Immeasurable

The main goal of the trip was to relax, get to know each other, and spend time together eating and celebrating, with a side of history and culture. We reached those goals many times over, and we received way more than we could have ever imagined.

As a corporation operating in different regions across Europe, we have always worked remotely and will continue to do so, working through screens, not seeing each other face to face. We even had employees who had never met any colleagues face to face on the trip. Faces were familiar, thanks to the screens, but a deeper connection with colleagues was still missing. After this trip, we truly are not just mystic characters on a Teams screen anymore. We are not just people with names and responsibilities. Now, we are colleagues who know each other much better. Colleagues with whom we can and dare to be our genuine selves. We recognise each other from our laughter. We are certain that from now on, we are going to be much more comfortable with contacting our colleagues and asking for help. We have discovered the real people behind the screen.

The food was delicious, and the history and surrounding environment were captivating, but above all, people welded together even stronger during the trip, and our trust deepened. Indeed, trust is the enabler for building brave and courageous culture of development throughout the entire organisation.

During the trip, we were able to setup four full scale workshops which often continued long into the evening in the form of conversation, accompanied by a glass of wine. The air was filled with belief towards the future – and, moving forward, innovating and sharing together will be that much easier.

Through the productive and entertaining workshop days, we were able to create synergy and launch inspiring new joint projects and ventures. Many of these projects would not have seen the light of day without our shared trip to Segovia.

Segovia Will Not Be Our Last Meeting

Our shared trips will continue, that much is certain! We are also going to organise meetings and events for individual teams more often in the future. We operate in several countries, so we will always work remotely with at least some of our colleagues, which means that people are missing out on coffee break chats – consequently, face to face meetings are more important than ever.

We will be reaping the fruits of this trip for quite a while – now, we know each other in a different way, and the increase in trust will create more efficiency, more results, more networks, more opportunities, and most importantly, innovation and new business operations.

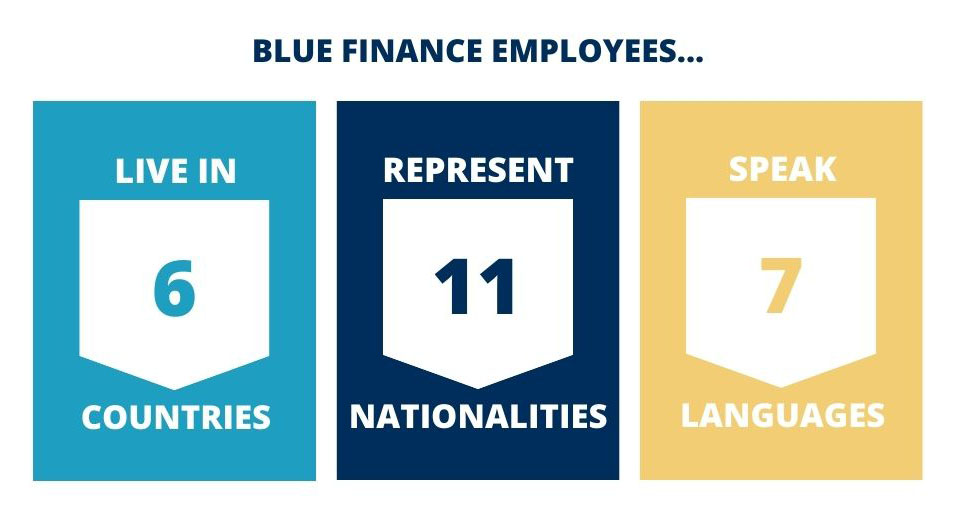

Did You Know This About Us?