Broaden’s revenue and customer numbers have shown steady growth during 2021 and the credit loss rate has remained very low. Strongest growth was seen on the P&T financing side. Corporate lending was also launched in Denmark.

Corporate lending is still a small, yet rapidly growing part of Blue Finance’s business. The company’s performance during the report period (January-September 2021) was good and we successfully managed to double monthly revenue year on year. In addition, corporate lending has been profitable throughout operations. The quality of our loan portfolio is at a good level and the credit loss rate is very low.

All the corporate lending services provided by the company are up and running and our main focus is on growing the customer stream. Our credit products are currently secured B2B loans and P&T (Purchase and Trade) financing, an asset-based inventory financing product particularly intended for the vehicle trade.

During the report period, we rolled out Axon, the Group’s new credit management platform. This allows us to grant more and better managed loans and makes it easier to manage our growing customer base.

January – September 2021 overview

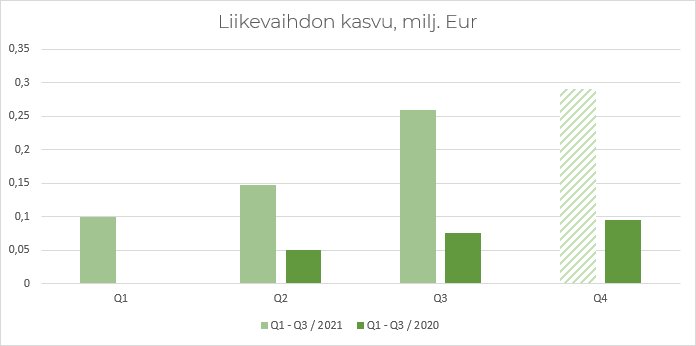

Revenue growth, €m

The figures for 2021 in this report have not been subject to audit. The figures in parentheses are the reference figures for the same period a year earlier.

- Revenue was €503,000 (€75,000), up 570%

- Operating profit was €227,000 (€34,000), equating to 45.1% of revenue

Strongest growth was seen in the company’s asset-based P&T financing, where both numbers of vehicles financed and customer flows have risen on a monthly basis. During 2021, we will provide P&T financing totalling €6 million.

We expect to see significant growth in secured corporate loans from the start of next year. Going forward, individual credit risks will be managed by keeping the average size of loans to an average of less than €20,000 and in principle by granting loans with a maturity of less than 24 months.

The readiness and ability of SMEs to grow have increased with the partial lifting of Covid-19 restrictions and this is clearly reflected in increased customer flow at Broaden. Our customers’ growing working capital requirement is reflected in greater demand for our corporate lending products.

Outlook

In 2021, we will reach lending of €6 million and next year expect to exceed €20 million.

We do not consider that the Covid-19 pandemic will have a major impact on our business going forward. No impact at all has been seen in P&T financing since the used car trade is currently in good shape in Finland.

Going forward, the new Axon platform will allow better risk management of corporate loans and minimum credit losses.

Based on feedback from customers and the interest triggered by our service concepts, we enter the rest of this year, and especially the upcoming 2022, on a positive note.

Broaden scalability in other countries

We have started rolling out the Broaden brand for use in the Group’s Danish subsidiary (broaden.dk) and the plan is still to begin B2B lending in Denmark in 2021.

Successful consumer credit in Denmark provides a good basis to also expect good results on the corporate lending side. The Danish SME market is around €91 billion, around 44% greater than the same market in Finland, which is around €63 billion. In addition to this, the Group’s business area also includes Poland, with an SME market of around €119 billion, almost double Finland’s.

We are implementing our profitable growth strategy by continuing to explore the potential to expand into new countries.